College Prep

Skip to content

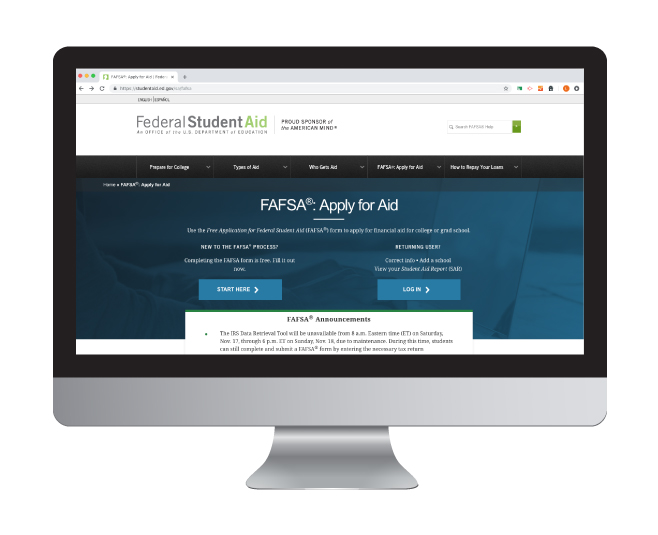

Paying for College

Know that college is an option for you.

Depending on the career path you choose, earning a degree can be the launchpad to your success! We encourage you to explore many career pathways and career experience opportunities. Thinking about your future can feel overwhelming. But you’re not alone — you’re surrounded by adults who have been there. Talk with your school counselors, professionals and family about college and career goals.

Step Two: Learn about the different types of financial aid

GRANTS

are based on a student's financial need and do not have to be repaid.

SCHOLARSHIPS

are awarded based on merit (academic, athletic or talent) and do not have to be repaid.

WORK STUDY

programs give you the opportunity to work for your college as a student and get paid. Income is tax-exempt.

LOANS

have a fixed interest rate and must be paid back to lending institution.